Roofing Insurance Fraud

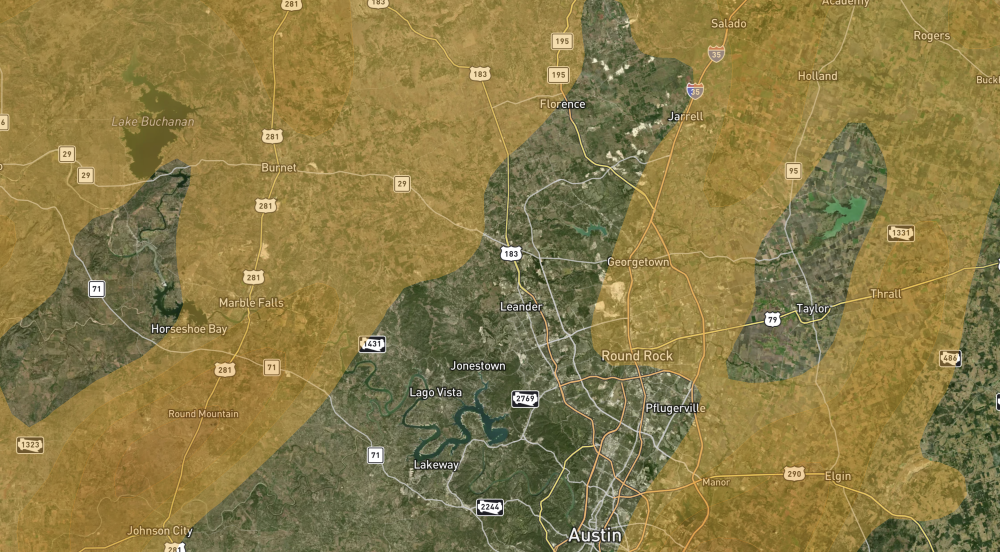

Roofing insurance scams can cost homeowners time and money, and can lead to liability for fraud. Learn more about how to identify and avoid common schemes.

Homeowners must be wary of scams by unscrupulous businesses purporting to offer roofing services. They may appear to be legitimate roofing contractors, but they often provide substandard services that ultimately leave homeowners in worse positions than before.

Some scammers engage in insurance fraud at the expense of both homeowners and insurance companies. Insurance fraud may be a misdemeanor or a felony under Texas law, depending on the amount of money involved. If a homeowner is not careful, they could be implicated in a scammer’s fraudulent scheme.

The following is an overview of common roofing insurance fraud schemes and how homeowners can be on the lookout for them.

What is roofing insurance fraud?

Image by Mario Ohibsky from Pixabay

Image by Mario Ohibsky from Pixabay

The goal of almost any form of insurance fraud is to obtain an improper payout from an insurance company. Roofing insurance scammers might inflate their costs on invoices submitted to homeowners’ insurance providers. They might use inferior materials so that their costs are less than the amounts billed to insurance companies. This leaves homeowners with roofs that are not in acceptable condition, and certainly not worth what they and their insurance companies paid.

Section 35.02 of the Texas Penal Code establishes penalties for insurance. It is a misdemeanor offense if the value of the claim is less than $2,500, and a felony if the value is greater than that. Many or most roofing insurance claims are around $10-12,000, which is a state jail felony punishable by a fine of up to $10,000 and/or a jail sentence of 6 months to 2 years.

What are some examples of roofing insurance fraud?

Roofing insurance fraud schemes can take many forms. They often have several common elements, such as the following:

Deductible assistance

Photo by Tonamel from Flickr [Creative Commons]

Photo by Tonamel from Flickr [Creative Commons]

Most insurance policies require the insured to pay a certain amount, known as the deductible before the insurance company is obligated to make a payout. Homeowners' insurance often expresses the deductible as a percentage of the home’s value. If a policy on a house valued at $400,000 has a 1% deductible, for example, the homeowner would be responsible for the first $4,000 of the cost of roof repair or roof replacement. The insurance company would pay for the rest.

Some roofers may offer to help a homeowner with the cost of the deductible. They may even advertise that they offer some form of “deductible assistance.” Many forms of deductible assistance are fraudulent.

In a typical example of deductible fraud, the roofer asks the homeowner to pay them less than the actual deductible. For example, if the homeowner has a $4,000 deductible, the roofer might ask them to pay $1,000. The roofer then uses cheaper materials so that they save at least $3,000, and they send a bill to the insurance company claiming that the homeowner paid the full amount of the deductible. The homeowner thinks they’re getting a good deal, but they’re not.Depreciation absorption

In homeowners insurance claims after a roof has suffered damage, an insurance company may send an appraiser to inspect the roof and prepare an estimate of the total cost. The insurance company sends a check to the homeowner, but they can withhold part of the amount as “recoverable depreciation.” The homeowner can get that amount if the roofer’s total cost is greater than the first check issued by the insurer.

A roofer can absorb the depreciation by issuing a fraudulent invoice that overstates the actual cost of the roofing job. The homeowner might not be aware that the roofer has inflated the costs. The roofer might pocket the extra money, or they might let the homeowner keep all or part of it.

Advertising reimbursement

Roofers sometimes offer to pay homeowners to place signs in their front yards advertising the roofer’s services. The fee might be the same as the deductible that the homeowner must pay. The roofer then overbills the insurance company.

Can a homeowner be held liable for roofing insurance fraud?

Image by Jan Mallander from Pixabay

Image by Jan Mallander from Pixabay

Some roofing insurance fraud schemes may implicate the homeowners if they participate in submitting fraudulent claims to their insurance companies or share in the fraudulent payout. If a roofer asks a homeowner to submit a fraudulent invoice, for example, it could look like the homeowner is involved in the scam. Texas law requires proof of “intent to defraud or deceive an insurer” in an insurance fraud case, but it would be ideal for homeowners to avoid even the appearance of being in on it.

What can a homeowner do if they suspect fraud?

Homeowners should be wary of any offers by roofers that purport to save them money on their deductible, or that seem too good to be true in any other way. You can report suspected insurance fraud to the Texas Department of Insurance.

Contact an experienced roofing project planner

RoofCrafters’ experienced professionals are transparent and careful to comply with insurance rules and regulations while performing the highest-quality workmanship. Contact a project planner today to start a free roof inspection.

Subscribe to RoofCrafters Inc's Blog